A Guide to the HDB Resale Portal

Starting from January 1, 2018, the HDB Resale Portal was introduced to assist buyers and sellers of HDB resale flats. This portal simplifies the entire resale process by consolidating all necessary procedures into one convenient platform. It also offers a user-friendly, step-by-step guide to assist both buyers and sellers throughout the transaction.

Utilizing the HDB Resale Portal brings several advantages, including:

- Decreasing the time required for the resale transaction by as much as 8 weeks.

- Minimizing the need for manual input of personal information.

- Integrating various services related to resale.

- Reducing the number of appointments with HDB to just one.

This portal provides immediate outcomes regarding your qualification to purchase a flat, housing grants, and HDB concessional housing loan. It also includes significant details like the Ethnic Integration Policy quota, upgrading status, upgrading costs billing status, and recent nearby resale flat transactions in the HDB Resale Portal.

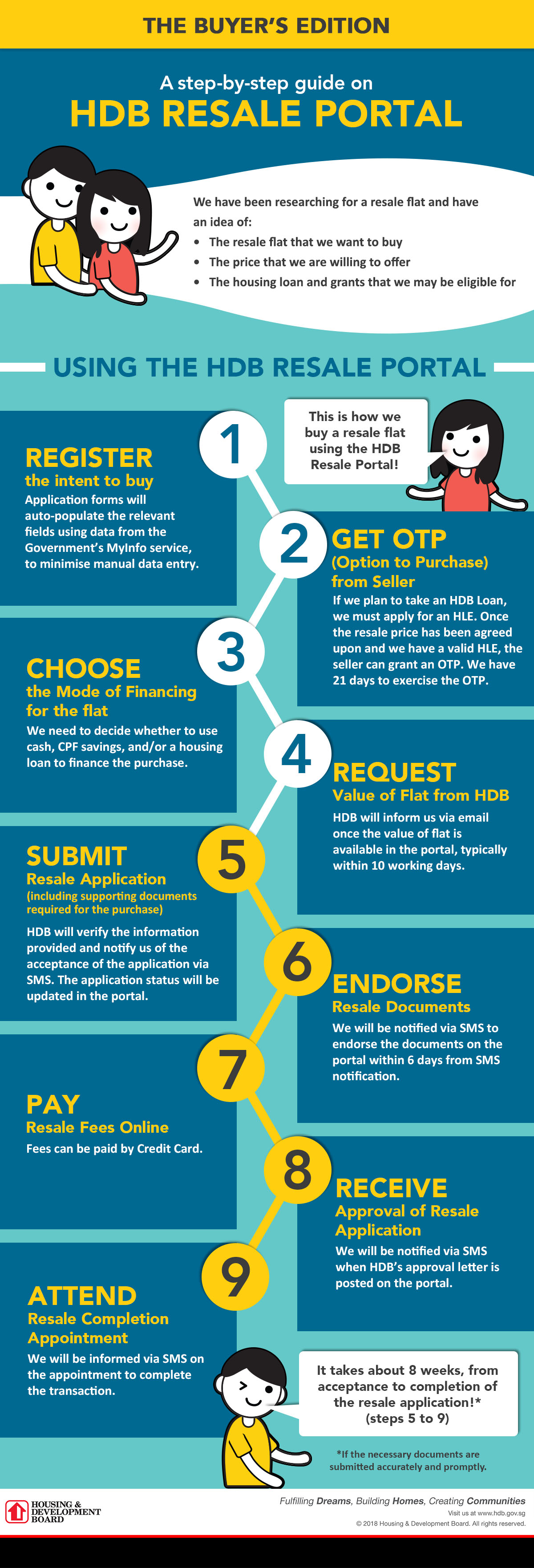

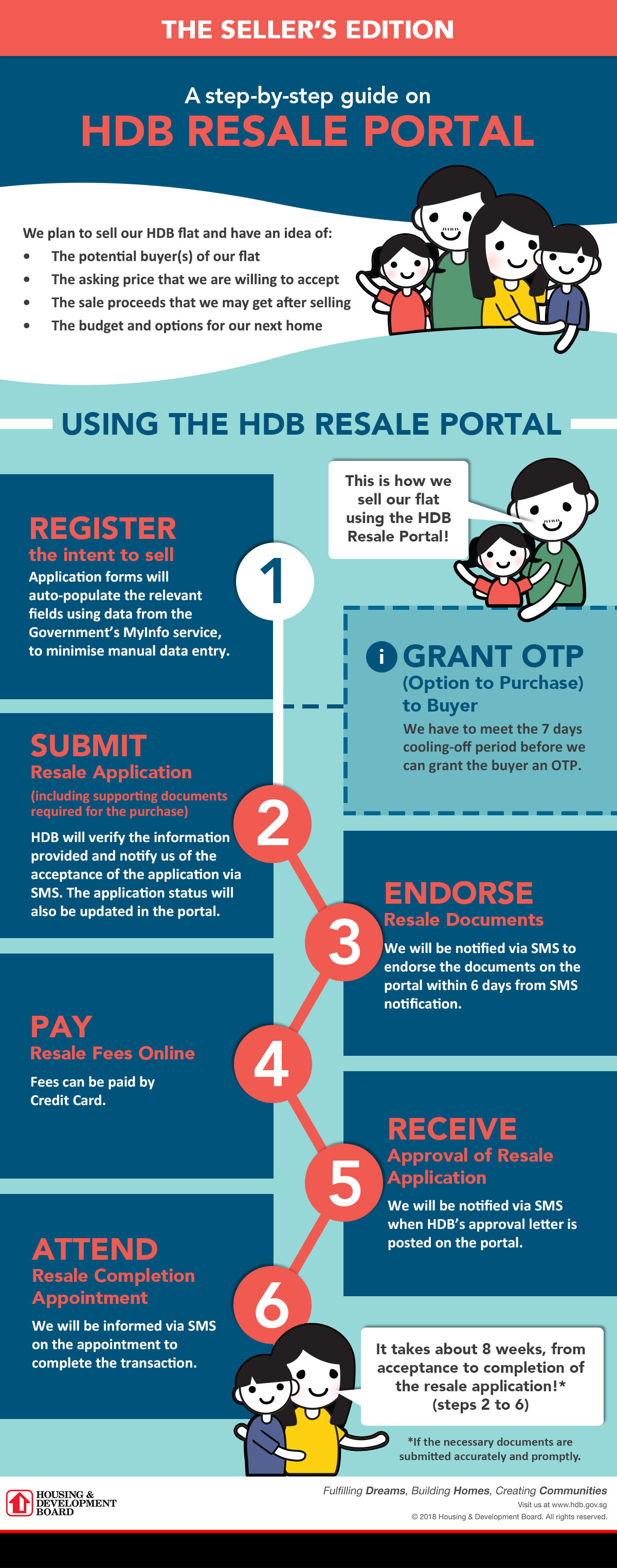

Here are the main steps to assist you in utilizing the resale portal:

1.Express your intention to buy/sell

Initially, you need to express your intention to buy or sell a flat on the HDB Resale Portal. Your personal information will be automatically fetched and filled in from the Government's MyInfo service.

2. Look for a flat and secure an Option to Purchase (OTP)

When you discover a secondhand flat that fits your budget, you must obtain an OTP from the seller. You have 21 days to finalize the OTP.

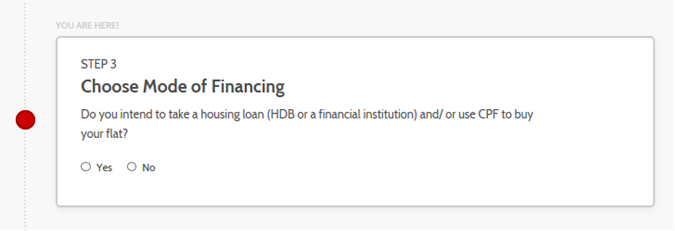

3. Determine the financing method

As a buyer, you need to decide how you will fund the purchase of the flat. You can use cash, CPF savings, or apply for a housing loan. If you opt for an HDB housing loan, the HDB Resale Portal will assist you in applying for an HDB Eligibility Letter.

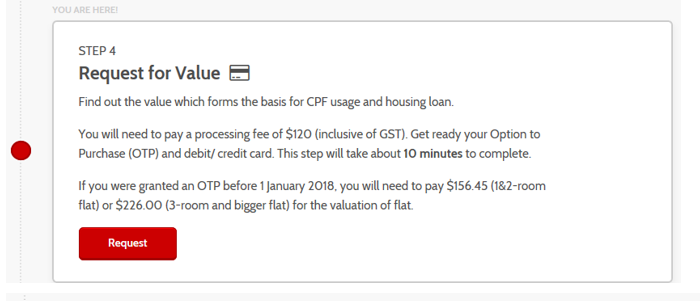

4. Ask HDB for flat value

If you're using your CPF savings and/or a housing loan to purchase the flat, you need to request HDB to determine the loan amount and the CPF savings you can use. This request comes with a processing fee of $120 (including GST).

After the seller grants you an OTP (Option to Purchase), you can submit a Request for Valuation to HDB. You must do this by the next working day after the OTP date, providing Page 1 of the OTP and the Request for Valuation.

If HDB decides that a valuation of the flat is necessary, their chosen valuer will inspect the flat within 3 working days after informing the seller. You can check the valuation of the flat on the HDB Resale Portal within 10 working days from the inspection date.

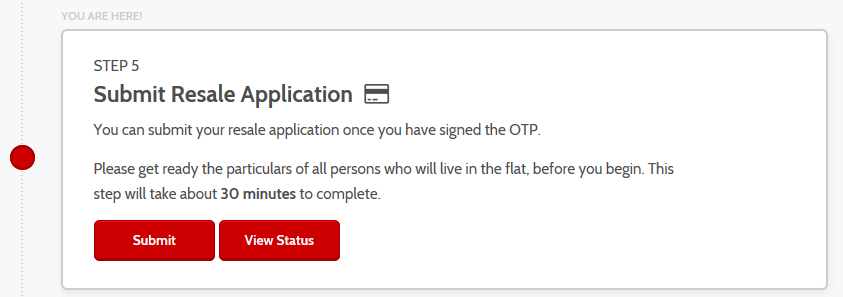

5. Complete resale application

After exercising the Option to Purchase (OTP), both buyers and sellers need to submit their parts of the resale application along with the required documents to the HDB Resale Portal. An administrative fee, which varies based on the type of flat, is required to be paid.

HDB will review the provided information and inform the buyers and sellers about the outcome of the application, usually within 8 weeks.

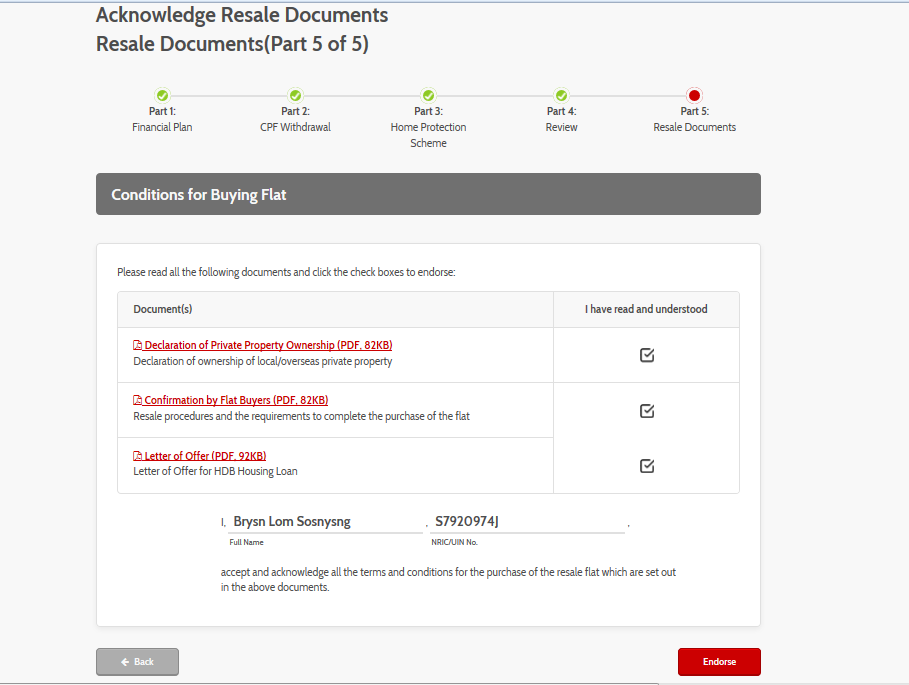

6. Recognize resale paperwork

HDB will calculate and create the necessary paperwork for buyers and sellers to sign in the HDB Resale Portal. Both parties need to sign the paperwork within 6 days.

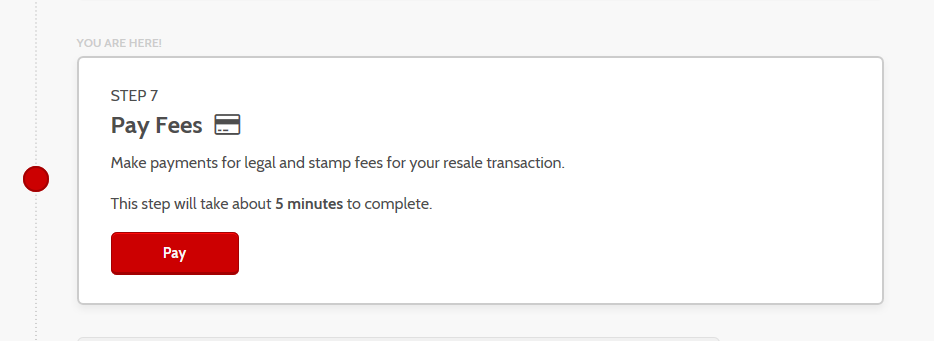

7. Pay additional charges

Buyers and sellers of flats must make online payments for the legal and stamp fees through the HDB Resale Portal.

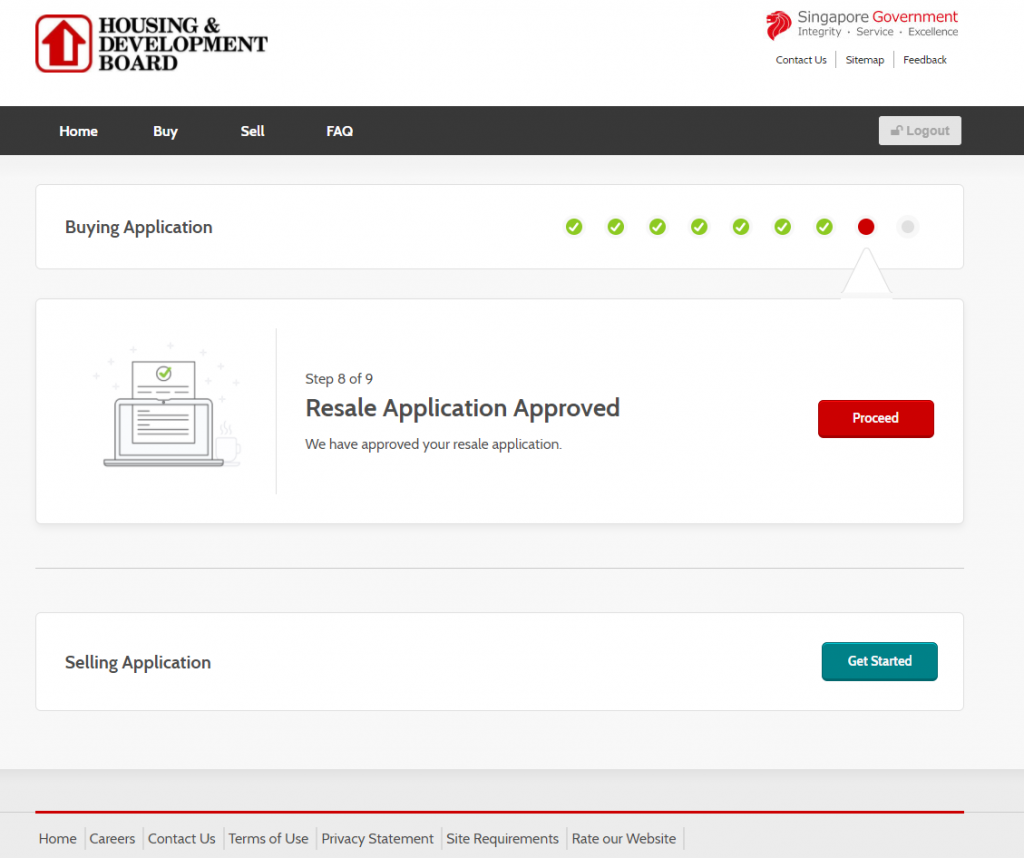

8. Be patient for the approval from HDB.

Once HDB gives the green light, they will notify both buyers and sellers of the flats. The approval letter can be accessed through the HDB Resale Portal.

9. Go to the Completion Appointment

Both buyers and sellers of flats need to be present at the HDB Hub for the Completion Appointment in order to finalize the resale transaction.

In short, here are the necessary actions for flat buyers and sellers:

Source: mynicehome.gov.sg