A Guide to Buying an HDB BTO Flat

Are you considering applying for a BTO flat but feeling unsure about how to begin? No worries! We've got you covered with a comprehensive step-by-step guide. In this article, we'll outline the entire process, pointing out important details to keep in mind and providing helpful tips for each stage of the application. Whether you're a first-time applicant or just need a refresher, this guide will walk you through everything you need to know to navigate the BTO flat application process with confidence. Let's get started and make your BTO flat dreams a reality!

| Content |

| Step 1: Sales launch Step 2: Check eligibility Step 3: Submit application Step 4: Receive outcome of application Step 5: Book flat Step 6: Sign Agreement for Lease Step 7: Collect keys to flat |

Step 1: Sales launch

BTO flats are made available for application every quarter. The exact application period is announced by HDB on the day of the sales launch. To stay informed about the projects being offered, it is important to follow MyNiceHome for the latest updates.

You can also visit the HDB Flat Portal and check out their social media channels such as HDB Facebook, MyNiceHome Facebook, Instagram, and Telegram. During a typical sales launch, multiple projects are introduced, and applicants have a week to submit their applications.

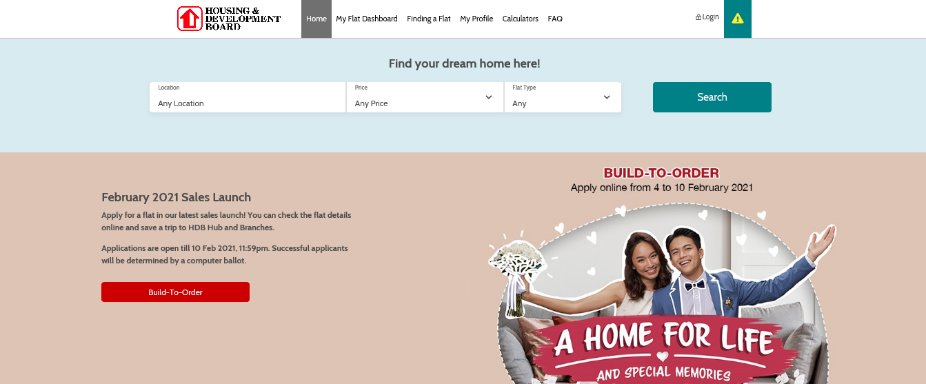

To access information about the projects and their prices, look for a banner on the HDB Flat Portal, similar to the one shown below. Clicking on it will take you to a listing page where you can find details. It's advisable to thoroughly review the information and discuss your options with your spouse or co-applicant before making a decision.

Homepage of the HDB Flat portal during Sales Launch

Pro Tip: Visit the HDB Flat portal beforehand. It provides information about upcoming BTO projects approximately 3 months before their launch. You'll find useful details like the site map, different flat types available, and the number of units offered for each project. This way, you can plan your purchase better and make informed decisions.

Step 2: Check eligibility

Interested in a potential apartment? Before applying, it's essential to ensure your eligibility. Take a look at the conditions below, and for further information, visit HDB InfoWEB.

Overview of eligibility conditions

| Eligible Applicant/ Family Nucleus | • You will need to qualify for a new flat under one of our eligibility schemes: Public Scheme Fiancé/ Fiancée Scheme Orphans Scheme |

| Citizenship | • At least 1 Singapore Citizen applicant • At least 1 other Singapore Citizen or Singapore Permanent Resident |

| Age | • At least 21 years old |

| Incoming Ceiling | • You are within the set income ceiling for the flat you intend to buy |

| Property Ownership | • All applicants and occupiers listed in the flat application do not own other property overseas or locally, and have not disposed of any within the last 30 months • All applicants and occupiers listed in the flat application cannot invest in private residential property from the date of flat application till after the 5-year Minimum Occupation Period (MOP) • You have not bought a new HDB/ DBSS flat or EC, or received a CPF Housing Grant before; or, have only bought 1 of those properties/ received 1 CPF Housing Grant thus far |

Source: HDB Infoweb

Before buying a flat, it's important to make sure you have enough funds available. In the past, this could mean spending time visiting various websites and pages to gather information. However, HDB has simplified the process through their new HDB Flat Portal. Now, you can conveniently gather all the necessary information in one place. The portal provides calculators that make it easy for you to figure out the financial aspects. This streamlining of information gathering saves you time and effort, allowing you to quickly and easily determine if you have sufficient funds to purchase the flat.

Step 3: Submit application

To apply online, applicants are required to pay a non-refundable application fee of $10 using MasterCard/VISA. You have a week to submit your application, and there's no need to rush as applications are not processed based on the order they are received.

After the application period ends, HDB will use a computer ballot system to process the BTO applications. This process determines your position in the queue for booking a flat.

Here's a helpful tip: You can increase your chances by applying through one of HDB's Priority Schemes. Additionally, make sure to check out the guide on using the HDB Flat Portal to submit your BTO flat application.

Step 4: Receive application outcome

You will receive a notification from HDB through SMS and/or email regarding the outcome of your ballot in around three weeks after the application period ends. For an additional option, you can also visit HDB InfoWEB or log in to My HDBPage to check the status of your application.

Step 5: Book flat

Once your application is approved, you will have the opportunity to reserve a flat starting from four weeks after the ballot results are announced. Before you visit HDB Hub in Toa Payoh for your appointment, ensure that you have all the necessary documents prepared.

During the appointment, you will be required to pay an option fee, which will be deducted from your downpayment for the flat. The specific amount will differ based on the type of flat you choose. Payments must be made through NETS.

| Flat Type | Option Fee |

| 4/5 room Executive | $2,000 |

| 3-room | $1,000 |

| 2-room Flexi | $500 |

If you are applying for the Enhanced CPF Housing Grant, you will need to submit the application form during the appointment.

Pro tip: With the new HDB Flat Portal, you can create a watchlist of your preferred units and receive notifications if and when they have been booked by others.

Step 4: Sign Agreement For Lease

Once you've booked your flat, HDB will invite you to sign the Agreement for Lease around six months later. It's important to gather the necessary documents for this process. If you're taking an HDB housing loan, you'll need a valid Home Loan Eligibility Letter (HLE) from HDB. On the other hand, if you're getting a loan from a financial institution (FI), you'll require a Letter of Offer.

Additionally, you'll have to make a downpayment for your flat, which varies depending on the loan type. For HDB Loan, it's 10% of the purchase price, payable fully with CPF funds from your CPF ordinary account. For an FI loan, it's 20% of the purchase price, with at least 5% paid in cash and the rest from your CPF savings.

Since financial institutions grant a maximum loan quantum of 75% of the purchase price, you'll need to pay the remaining 5% in cash or CPF savings when collecting your flat's keys. The cash amount depends on the loan ceiling.

To use CPF savings for payment, ensure you have Singpass and a mobile phone or OneKey token for 2-factor authentication. Singpass registration and 2FA activation may take up to 10 working days, so prepare them ahead of time.

Pro tip: When choosing between an HDB housing loan or an FI loan, consider various factors. Check out this article for a comparison of the two financing options.

Step 7: Collect keys to flat

Once the construction of your flat is finished, HDB will inform you to visit their office for key collection. The process is simple, and you will receive guidance from knowledgeable HDB officers. Make sure to bring the required documents with you, collect your keys, and celebrate becoming a proud homeowner!

Pro tip: Planning your home renovation requires creativity and time! Begin early by referring to the Guide to Planning Your HDB Home Renovation for helpful insights.

Source: mynicehome.gov.sg