Buying an HDB Flat? Here’s How to Decide Between HDB Loans and Bank Loans

HDB loans or bank loans? That's a common question for first-time homebuyers who have decided to purchase an HDB flat. Let's explore the differences between the two options.

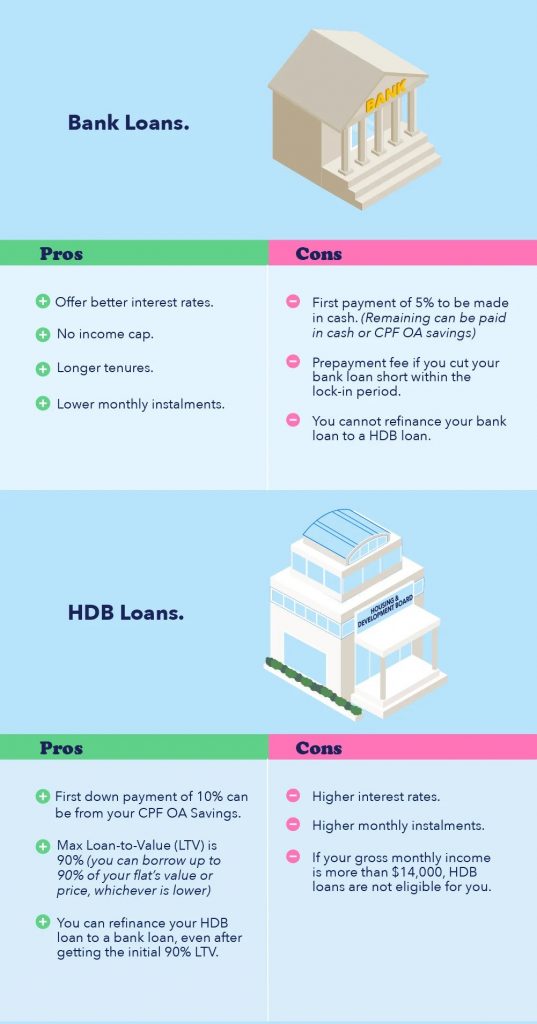

Downpayment:

One advantage of choosing an HDB loan is that it requires a smaller cash outlay. With an HDB loan, you can borrow up to 90% of the flat's value or price, whichever is lower, while using a combination of cash or CPF OA savings for the remaining 10% downpayment. On the other hand, bank loans have a maximum loan-to-value ratio of 75%, meaning you'll need to provide an additional 15% in downpayment compared to an HDB loan. Out of this 15%, 5% must be paid in cash, with the remaining 20% paid in cash and/or CPF OA savings.

Interest rates and monthly instalments:

HDB loans have a fixed interest rate of 0.1% above the prevailing CPF rate, currently at 2.5%. This means the interest rate for HDB loans stands at 2.6% per annum. Bank loan interest rates, on the other hand, are more variable and depend on market conditions. These rates can be tied to benchmarks such as SIBOR, SORA, BR, or FHR, with the interest rate being the prevailing rate plus the bank's spread. Bank loan rates have historically ranged from 3% to 4% per annum, but due to the Global Financial Crisis, they have remained low for the past decade, currently averaging around 1.8% per annum. Lower interest rates generally result in lower monthly repayments.

Comparing loan options: While HDB loans offer a smaller cash outlay and a fixed interest rate, bank loans provide more variability in interest rates and may currently be more affordable. However, it's important to note that you can switch from an HDB loan to a bank loan, but not the other way around. Consider factors such as your financial situation, risk tolerance, and long-term plans before making a decision.

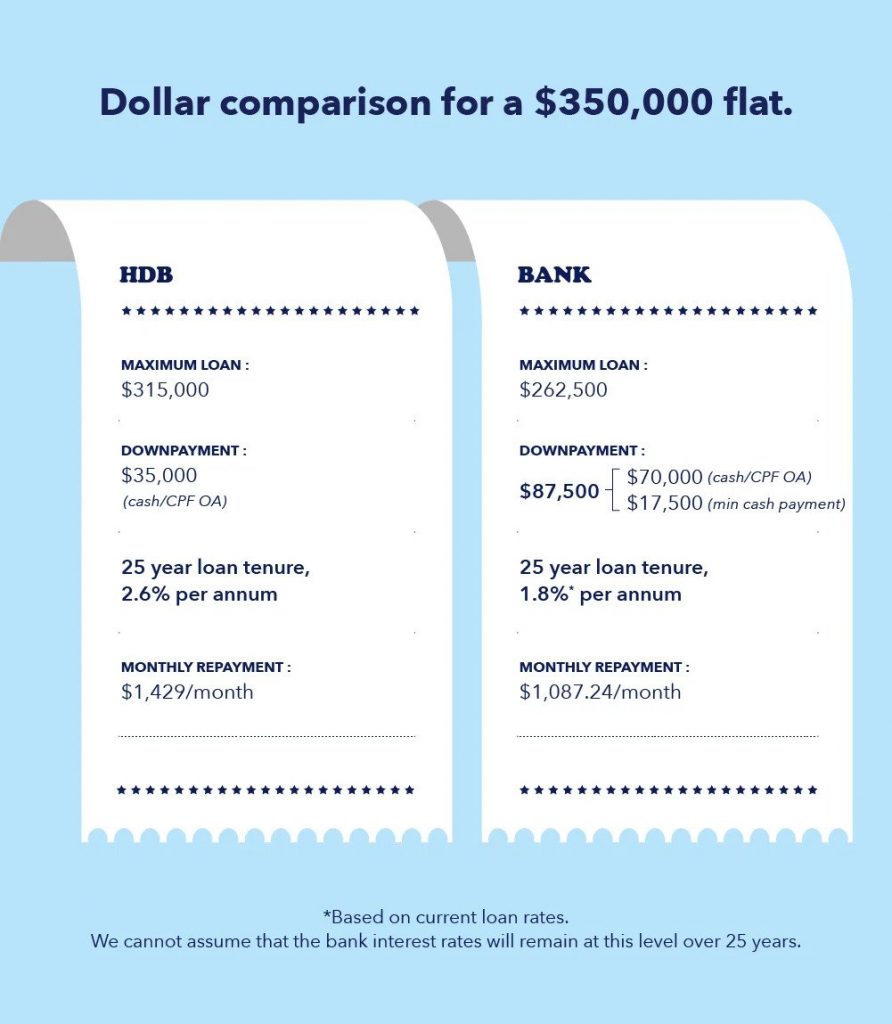

For example, if your chosen flat is priced at $350,000, with an HDB loan you could borrow up to $315,000 (90% of the flat's value) and pay a downpayment of $35,000. Assuming a 25-year loan tenure, the monthly repayments would amount to $1,429.

In contrast, if you’re taking a bank loan with an LTV of 75%, the loan quantum will be S$262,500. And the downpayment will be S$87,500.

On a 25-year loan tenure, assuming an interest rate of 1.8% per annum*, the monthly repayments will be cheaper at S$1,087.24.

*This is based on current, typical loan rates. We cannot assume that the bank interest rates will remain at this level over 25 years.

Income Cap:

HDB loans have stricter eligibility criteria, including an income ceiling. If your gross monthly household income exceeds S$14,000, you won't qualify for an HDB loan. Bank loans, on the other hand, do not have an income cap, making them suitable for higher-income individuals.

Tenure:

HDB loans have a maximum tenure of 25 years, while bank loans for HDB flats allow for a longer tenure of up to 30 years. However, if the loan tenure exceeds 25 years, the Loan-to-Value (LTV) ratio is reduced to 55%. Longer loan tenure allows for lower monthly repayments but also means paying higher interest over time.

Refinancing: With an HDB loan, you have the option to refinance into a bank loan, subject to the bank's approval. This can be beneficial if you find a bank loan with a lower interest rate, as it helps reduce your monthly repayments. However, you cannot refinance a bank loan into an HDB loan. Instead, you can consider repricing the loan with the same bank or switching to another bank for refinancing.

Early Repayment:

One advantage of HDB loans is that they do not have an early repayment penalty. You can make early repayments or partial capital repayments to reduce your financial commitments. In contrast, if you have a bank loan, it's generally not advisable to repay it early due to prepayment fees imposed by the bank during the lock-in period.

Which Option is Better? If you have a tight budget, an HDB loan should be considered first as it requires a smaller cash outlay. The fixed interest rate of an HDB loan provides clarity regarding monthly repayment amounts. If you find the interest rate to be high, you can always refinance from an HDB loan to a bank loan later. However, the reverse is not possible.

If you plan to upgrade quickly, such as selling your HDB flat and purchasing a private property, a bank loan or refinancing into a bank loan may be more suitable. This can help lower your monthly repayments and minimize interest expenses, potentially maximizing resale gains.

Consulting a mortgage broker can provide valuable insights and help you better understand suitable home loan options for your specific circumstances.

Embarking on your home ownership journey? Check out resources that explain CPF housing grants, as well as a guide on using the HDB Flat Portal for purchasing your HDB flat.